Looking for ways to grow your business?

We're here to help

Welcome to the go-to place to level up your business with sales and marketing resources.

Featured blog post

Growth / Planning & Strategy

The Small Business Guide to Growth: 16 Tips on How to Expand a Small Business

Apr 11, 2018 · 16 min read

Read blog postFeatured blog posts

NEW

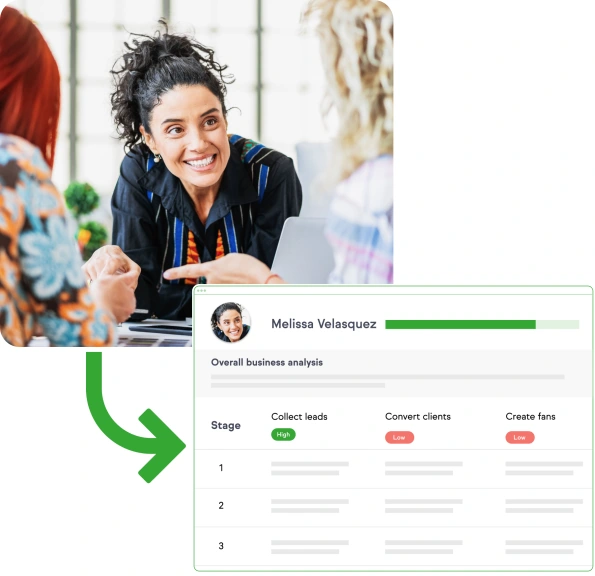

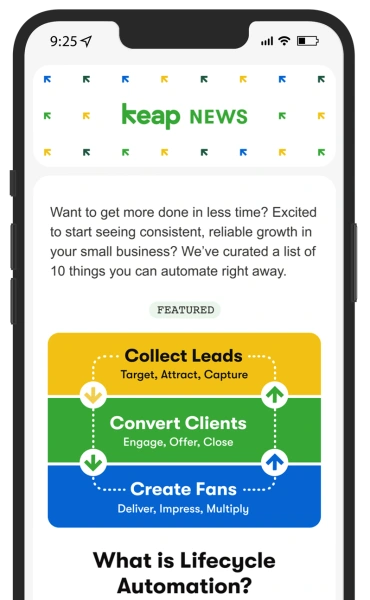

Take a free 7-minute automation assessment

This quick-and-easy Lifecycle Automation assessment will:

Identify your sales & marketing strong points and weak points

Compare against to other businesses like yours

Identify gaps in your current strategy & execution

Uncover exciting opportunities for growth

Have actionable next-steps to grow your business

Are you ready to level up your business?

Start assessmentFeatured Webinars

Relevant topics for expanding your business knowledge and increasing your revenue

Insightful courses

Helpful hands-on sessions with proven experts, all created to help you grow

Free tools and guides that our customers love

Even more growth-focused resources to keep on hand at all times

A new community dedicated to growing your business with the education and resources you need to thrive

Learn More

Subscribe to our newsletter

Sign up here for useful content, relevant posts, special offers, and upcoming events, delivered right to your inbox.