Tax season is just around the corner. If you don’t have Bench handling your bookkeeping and taxes, the burden is upon you to meet the filing deadlines.

Whether you’re completely organized or still scrambling to gather records and receipts, here’s the key info you need to know to get your taxes filed on time:

Tax filing deadlines

Which forms you need to file, and when, depends upon the structure of your business. Your filing to-do list is also affected by whether you paid contractors during the past year.

Quarterly estimated tax deadlines

If you file quarterly estimated taxes, the due dates for 2020 are:

- April 15: First estimated quarterly payment

- June 15: Second estimated quarterly payment

- Sept. 15: Third estimated quarterly payment

- Jan. 15 (2021): Fourth estimated quarterly payment for the 2020 tax year

You can estimate and pay your quarterly tax using IRS Form 1040-ES.

Form 1099-MISC deadlines

If you paid a contractor more than $600 for services in 2019, you’re required to file Form 1099-MISC, with one copy going to the contractor, and one copy going to the IRS.

Copy A:

The deadline to file Copy A of Form 1099-MISC with the IRS is Jan. 31—so long as you’re reporting payments in box 7.

If you’re not reporting payments in Box 7, the deadline is March 31 to file electronically.

Copy B:

The deadline for sending Copy B of Form 1099 to your contractors is Jan. 31. But, if you’re reporting payments in Box 8 or 14, the due date is Feb. 18.

The due date is extended to Feb. 17 if you’re reporting payments in Box 8 or 14 of 1099-MISC.

Tax deadlines for sole proprietorships

If you’re a sole proprietor, the tax filing deadline for Form 1040 (including Schedule C) is April 15. This is also the deadline to file for an extension.

Tax deadlines for LLCs

If you’re an LLC electing S corporation or partnership status, the filing deadline for IRS Form 1065 or IRS Form 1120-S, respectively, is March 16.

Tax deadlines for partnerships

If your business is a partnership, the filing deadline for IRS Form 1065 is March 16.

Tax deadlines for S corporations

If your business is an S corporation, the filing deadline for IRS Form 1120-S is March 16.

Tax deadlines for corporations

The tax deadline for C corporations to file IRS Form 1120 is April 15.

How to apply for a tax extension

If you're getting a sense that you won’t be able to file your taxes on time, you should immediately file for an extension because if you file late you must pay a penalty. The IRS charges 5% of your outstanding income tax balance, plus an additional 1% for every month you fail to file, up to a maximum of 12 months. So, if you file your taxes 12 months late, you’ll pay an extra 17% on your taxes.

The automatic six month extension

You can qualify for a six-month extension of your tax filing deadline if you’re:

- An individual working in a combat zone in support of the U.S. Armed Forces (your spouse is included)

- You’re a member of the military serving outside of the U.S.

- You’re a U.S. citizen living and working out of country

- You’re a U.S. citizen living in parts of the country that have been affected by severe natural disasters

How to apply for a sole proprietorship tax extension

The easiest ways to receive a tax extension for your sole proprietorship are through the IRS payment portal or by filing IRS Form 4868 online.

Filing for an extension through the IRS payment portal

If you intend to pay your taxes online, the quickest way to get an extension is through the IRS payment portal. Log in to the portal, choose “Direct Pay with Bank Account,” and select “Extension” as your reason for payment.

Filing for an extension with IRS Form 4868

You can also file for an extension by submitting IRS Form 4868 online.

If your income is less than $66,000, you can do this using Free File software. If it’s more than $66,000, you must file using Free File fillable forms.

How to file for a partnership, S corporation, or C corporation extension online

If your business is a partnership, S corporation, or C corporation—or an LLC filing as one—you’re more limited in how you can file for an extension.

You’ll need to file IRS Form 7004 through the IRS’ e-file service. If you’re filing more than one return, you must file a separate Form 7004 for each.

After specifying which return for which you’re filing an extension, use Form 7004 to let the IRS know:

- If your organization is a foreign corporation without an office or place of business in the U.S.

- If your organization is a corporation and the common parent of a group that will be filing a consolidated return

- If the organization is a corporation or partnership that qualifies under Regulations section 1.6081-5

- The dates of your calendar and tax years

- Whether you’re filing a short tax year, and if so, why

You’ll also need to provide an estimated total for the taxes you have due, and information on payments you’ve made or credits for which you qualify.

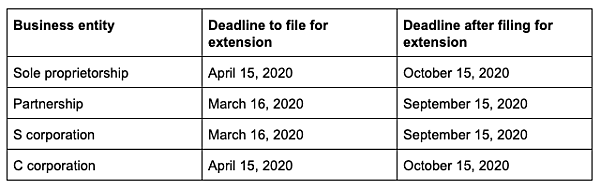

Tax extension filing deadlines

The deadline to file for a tax extension is the same as your tax filing deadline.

Final thought

Tax season can be stressful, but remember you can always file for an extension to avoid penalties.

Even with extensions as a saving grace, filing taxes for your small business can take up your valuable time and energy. If that’s the case, consider using BenchTax. Bench will handle all of your bookkeeping tasks throughout the year and then, when it's time to pay your taxes, BenchTax will get you filed accurately and on time.

Take control and wow customers with the best client management and automation software for small businesses. Try us free for 14 days! https://t.co/QFCpZ83Wgb pic.twitter.com/izMSggdzmd

— Keap (@KeapGrowing) February 8, 2020