For many small business owners, access to a little extra working capital would be the golden ticket to reaching for their company’s next level of growth. All the same, no wise entrepreneur can even contemplate taking out a loan to fund their business without asking in the very same breath—but how do I get one, and what will it cost?

Maintaining positive cash flow is a delicate act that is key to the survival of small businesses. With slow-paying clients, seasonality, or an unexpected opportunity such as a big order—many owners find it challenging to keep their working capital out of the red.

Given the natural ebbs and flows inherent in small business, finding yourself in a cash crunch will likely become a reality at some point in the life of your business.

Fortunately, there are many types of business loans available that will get you the working capital you need without breaking the bank.

This comprehensive guide will walk you through the options for affordable loans, how to find them, and the details of applying for a small business loan.

Types of business loans

Fortunately, with the proliferation of alternative and online lending, there are several loan options that can help you improve your working capital position. They can be excellent resources if used correctly.

To help you understand your options, let’s look at the most common and affordable types of business loans, along with the pros and cons of each.

Bank loans

There’s simply no denying that a traditional bank loan for business probably offers the lowest interest rate around. If you’re looking for single-digit interest rates, a bank loan is an obvious choice. The problem, though, is that if your business can qualify for a small-business loan from a traditional bank, you probably don’t actually need one.

Since the 2008 recession, banks have severely tightened the reins on loans made to small businesses. Citing the high risk of small-business lending, many of the largest banks have left this sector almost completely. As a result, many hopeful business owners find themselves completing lengthy bank loan applications and waiting through long underwriting processes, only to be turned down for a bank loan.

Only top-tier borrowers have a chance of qualifying, which means you need to have perfect credit, strong revenue, profitability, cash flow, years in business, and more. Otherwise, you’re likely better off sacrificing a couple of percentage points in annual interest to pursue a more accessible type of business loan.

Bank lines of credit

A bank line of credit is a slightly different type of business loan but comes with similar interest rates and most of the same pros and cons as a traditional bank loan. Essentially, a bank line of credit works similarly to a credit card, offering you a certain amount (or “line”) of funds available from which you can draw as needed. The added benefit of a small business line of credit is that you pay interest only on the funds you actually use, allowing you to further minimize your cost of borrowing.

Like with bank loans, lines of credit from traditional banks also tend to involve long application processes and very stringent qualification standards, so those with less than perfect credit need not apply. As an alternative, though, many online alternative lenders also offer lines of credit in their product lines with most of the same benefits as a bank line of credit.

SBA loans

In many ways, obtaining Small Business Administration loans (loans through one of the U.S. SBA loan programs) may be the best possible option for small business owners. That’s because an SBA loan rate is lower—typically starting at 6.5 percent interest—like a bank loan, but the SBA has accessible qualification standards than you may find working directly with a bank.

Here’s how it works: Rather than lending money directly to small-business owners, the SBA works with intermediary lenders (i.e. the same banks you’d likely be working with to obtain the two products above) to guarantee a portion of the approved borrower’s loan. This guarantee means that if your business fails or you default on your debt, the SBA promises to cover the lender’s costs. By managing this risk, the SBA incentivizes banks to accept small-business loan applications that they may otherwise turn away.

The biggest downsides to applying for a small business loan through the SBA are time and paperwork. Because both the agency and the lender have their own separate application requirements and underwriting process to go through, approval and funding for an SBA loan will take at least a month—and sometimes much longer. If you’re holding out for this low-cost option, prepare to hit the pause button on your business growth while you’re waiting for funds.

Long-term online loans

Functionally speaking, there is very little difference between a long-term online loan provided by an online alternative lender and a traditional bank loan. A borrower seeking a long-term loan will typically find the same payment schedules, with the main differences being functions of accessibility, timing, and cost.

Because online alternative lenders use a wider variety of methods and more lenient qualification standards to determine a borrower’s eligibility for a loan, they accept a much higher percentage of applications than bank lenders do. Simply put, you have a far better chance of being approved for online business loans from alternative lenders than you do from your local bank.

And because of the online lenders’ heavy use of technology in their underwriting process, they can review and approve loan applications far more quickly, getting you cash in hand within just a few days. That’s great news for business owners eager to get started quickly with their business growth, and these are often the best small business loans for unexpected cash-flow crunches.

Invoice financing

If slow-paying clients are the only thing standing between you and the working capital you need, invoice financing may be an ideal option. By using your invoices as collateral, you can get an advance of up to around 85 percent of your outstanding invoices in as little as one day.

Once your customers pay their invoices, you’ll receive the balance you’re due—minus the fees charged by the lender. This will likely include a processing fee of around 3 percent and a factor fee of around 1 percent per week until full payment is received.

Compared to other types of business loans, invoice financing is more expensive. However, it is an effective way to get cash quickly if you find yourself in a pinch.

Term loan vs line of credit: What’s the best option for your small business?

Both a term loan and a business line of credit are great financial tools for entrepreneurs—but how does each one work, and which one is better for your business?

Here’s the breakdown:

Term loan

A term loan is a lump sum borrowed from a lender and paid off at certain intervals over a set period of time. Term loans are typically paid back on a bi-weekly or monthly basis, over a period of one to five years. If you’ve bought a car or a house, you’re probably at least a little familiar with term loans.

Term loans are a little stricter when it comes to how they operate, though. As opposed to borrowing and repaying as you go, a term loan is given in one lump sum payment and is repaid within a specific time frame, or term (short, medium, or long-term loan).

Also unlike a business line of credit, you must begin repaying a term loan as soon as you get it, and once the loan funds are gone, you’ll need to reapply for a new one.The nice thing about a term loan is that they come in different shapes and sizes and there are options for creditworthy businesses, as well as those who may be younger and still building their financial and credit history. As well, since a term loan is a transaction and a line of credit is continuous, they tend to be a bit easier to qualify for.

There are two key terms to know that will help you to better understand the cost of a term loan: the interest rate and the annual percentage rate (APR.)

The interest rate is the percentage of the principal amount that the lender charges you to take out the loan. Interest rates can vary from loan to loan, and that variance generally can be understood as a reflection of the loan’s riskiness to the lender. When applying for a small business loan, the better you are able to demonstrate your ability to repay the loan amount, the better the terms of the loan are likely to be.

Interest rate alone won’t tell you the full story, however. The APR is a more effective tool for getting a holistic view of the loan’s total cost. The APR reveals the bottom line of what the loan will actually cost you each year by tallying up the average of the total interest you will pay, including fees and service charges. It’s an important number to pay attention to when comparing types of business loans because, while a loan may appear to have a low-interest rate, a high APR will reveal any underlying fees.

When does a term loan make sense?

A term loan can be used to meet virtually any business need, like working capital and paying back other debts, but works best when used for more long-term investments, such as new equipment or expansion.

Term loans usually aren’t the right choice for shorter-term needs, such as a cash shortage or an expense you can pay off fairly immediately. If the need is one that either A) you don’t expect to increase your profitability, or B) can be paid off in the next few months, then a term loan may not be the right choice. In both scenarios, the loan may ultimately be a drain on your cash flow.

Some common use cases for term loans include:

- Opening a new storefront or otherwise expanding your space

- Hiring new employees

- Developing an e-commerce space or revamping your website

- Refinancing high-interest debt

- Investing in new equipment or technology that will grow your business

Small business line of credit

There are two major questions most small-business owners start asking when it comes down to a loan vs line of credit: How does a business line of credit work differently than a loan? And what’s the difference between a credit line vs credit card?

Much like a credit card, a business line of credit can come in handy when you’re in a pinch and need extra cash—fast. Business credit cards, however, tend to have higher interest rates and charge additional fees for cash advances, but the concept is similar. You’re allocated a set limit of financing that you can access at your leisure, and you accrue interest only on the money you pull from your line.

For example, let’s say you have a line of credit for $10,000 and you need $5,000 to replace a bad batch of inventory; you’re only required to pay back the $5,000 you borrowed, plus interest. So if the interest were set at 10 percent, you’d owe a total of $5,500 (or $5,000 plus $500 in interest).

The other huge benefit to a line of credit is that it’s “revolving.” So once you’ve repaid your debt, you’ll have access to the full $10,000 without reapplying. You’re able to draw and repay funds as you wish, so long as you don’t go over your credit limit.

A business line of credit can be secured with inventory, receivables or other collateral, but the most commons lines of credit are typically unsecured debt.

When does a business line of credit make sense?

Think of a business line of credit as more of a safety net. Since there’s typically no operating charge for a line of credit, it’s best to apply for one when you don’t actually need it, so when you do, you won’t have any setbacks.

A business line of credit is best used for short-term financing needs and operating expenses like payroll, temporary cash flow shortages, and so on. While you can use the money for a long-term investment, it’s best to not tie up your credit line, so when an emergency does arise, you’ll have it at your disposal.

Applying for a small business loan or line of credit:

What lenders are looking for

There are certain requirements that need to be met in order to actually get approved for the small business loan you need. If you don’t meet those requirements, putting together the application will turn out to be a total waste of time.

Though every lender will have their own process, here is a checklist of the most common things they look at:

1. Personal credit score

While your personal credit score doesn’t really say anything about your business, it remains an important factor in securing business credit. As a small-business owner, the benefit of maintaining a good personal credit score will probably never go away. Lenders look at your personal credit history as a measure of your past credit performance and your willingness to meet your financial obligations. There’s a difference between can you repay a loan and will you repay a loan. Your personal credit score is one way many lenders predict whether or not you will.

The good news is that different lenders have different personal credit thresholds they’ll accept. If your score is below 680, you’ll likely not have any success at the local bank, and if your score is below 650, an SBA loan probably isn’t in your future either. However, many online lenders will accept a lower credit score, provided other metrics are in place. Nevertheless, if you have a less-than-perfect credit score, making efforts to improve your score often results in more options, better terms, higher approval rates and lower interest rates.

Experian, Equifax, and Transunion are the three major personal credit-reporting bureaus.

2. Your business credit profile

Unlike your personal credit score, your business credit profile speaks directly to how you meet your business obligations. Dunn & Bradstreet, Experian, and Equifax create profiles and scores based upon how timely you pay your vendors, how current you are with your business credit card payments and how you pay your other business-related bills. It also includes the type of industry you’re in and how other businesses like yours perform over time.

In addition to lenders evaluating your business for a small-business loan, potential suppliers can also look at this score to determine your “willingness” to make timely payments and whether they should offer you 30-day terms or other vendor credit.

Predicting the future requires looking into the past. This can be problematic for new businesses that haven’t been around long enough to build a business credit profile. If that describes your business, you can start by establishing business credit by purchasing office supplies at places like Staples or Home Depot. These retailers regularly report to the business credit bureaus so your payment history there can help you build a good credit profile.

3. Time in business

Depending on the lender, the criteria could be a year or less up to several years in business. Some business owners might ask, “Why does how long I’ve been in business make a difference?” The short answer is, lenders are a pretty risk-averse bunch, and lending to small businesses carries risk—the younger the business, the greater the risk. Particularly when you consider the statistic that roughly half of the small businesses that start today won’t be around to celebrate their fifth birthday.

Time in business speaks to a track record that can be measured and evaluated. The longer you’ve been in business, the more a lender will be able to measure whether or not you “can” and have met your business financial obligations.

4. Annual revenue

This is another way a lender measures whether or not you’ll be “able” to repay a loan. If a business has no revenue, how is its owner going to make regular and timely payments? Unlike an equity investor, who invests in a business for a cash event in the future, a lender is expecting a regular payment. They want to validate that you can make the first payment—and every subsequent payment.

Before approving your loan, lenders will look into the financials of your company to see that you have enough money to cover both your operating expenses and your loan payments. The general rule of thumb is to limit your total loan amount to less than 12 percent of your company’s total revenue. This way, even if emergencies do arise, you should still have enough cash on hand to make your loan payments.

5. Cash flow and average bank balance

In addition to annual revenue, some lenders want to look at your monthly bank statements to evaluate your cash flow.

Even if you’re pulling in enough revenue to cover operating expenses and future loan payments, lenders know that unexpected expenses come up in business. If every dollar that comes into your business goes to operating expenses and loan payments, it doesn’t leave you any wiggle room should you get a bad batch of inventory, or find you need to replace an important piece of equipment. Because of this, your lender will also expect you to have some form of cash cushion in your bank account to cover the unexpected without getting behind on your loan payment.

In addition to the traditional monthly payment terms, most of us are familiar with, some lenders offer weekly or even daily repayment terms. How cash flows in and out of your business could impact your ability to meet payment obligations.

For example, weekly or daily payment terms require more frequent transactions and deposits than monthly repayment terms. The nature of your cash flow could influence whether some types of business loans are available to you. That’s why some lenders want to see your bank statements; they want to verify that you have the right type of cash flow to meet the loan terms.

To better appeal to lenders, aim to have three months’ worth of expenses saved. If that goal seems out of reach, start with a padding of at least $1,000. But remember—the more cash on hand you have, the more appealing your loan application will be.

6. Loan purpose

There are a number of reasons a potential lender would like to know the loan purpose. Knowing the loan purpose helps the lender identify the type of loan that would be a good fit—or if other loan products would be a better fit. For example, there are specific loans designed to purchase equipment, buy a franchise, or purchase commercial real estate.

Loan purpose can also help identify whether a long-term or short-term loan would meet your needs. In the same way, most of us wouldn’t consider purchasing a new car with a 30-year mortgage, some loan types are more appropriate for purchasing inventory than heavy construction equipment.Additionally, some loan purposes eliminate loan options. An SBA 7(a) loan can’t be used to consolidate debt or pay off an existing loan, for instance.

7. Collateral

While some lenders approach collateral differently than others, collateral helps mitigate risk for the lender. A small business loan secured with collateral (something of value) allows a lender to recoup some of their losses should a borrower default. Traditional lenders like banks often secure a small-business loan with collateral like equipment or real estate. And while the SBA doesn’t always require a loan to be 100 percent collateralized, they often require all the collateral a borrower might have.

In addition to verifying that you can repay a loan and that you will repay a loan, lenders also want to know what will happen should something go wrong and you can’t make your loan payments. In addition to requiring a little personal skin in the game, collateral gives lenders options in the event you can’t continue to make payments.

Get your business and financial documents ready

Your lender may request many types of documentation related to your business, so the sooner you collect and organize those documents for submission, the easier your loan application process will be.

Document requests can vary from lender to lender, but these are the basic business documents you should have at the ready when starting a business loan application process:

Business organization and legal documents:

- Articles of Incorporation, Shareholders Agreement, LLC Agreement, Partnership Agreement, Doing Business As filing, or similar

- All relevant business licenses and permits

- Title deeds for any real estate owned by the business

- Patents, copyrights, trademarks, or other proof of intellectual property rights

- Lease documents for all business premises

Banking and tax documents:

- Business income tax returns from the past two years

- Property, business, sales, municipal, or other tax statements

- Bank statements from the previous six months

- Payroll records from the past six months

Financial statements:

- Current balance sheet

- Profit and loss statement for the past year

- Accounts receivable statement

Personal documents:

- Personal tax returns for the past two years

- Title deeds on personal real estate for possible collateral

Write your personal and business background statements

Though it's not required by all lenders, writing a statement detailing your personal and business background can help to build trust with your lender, making them more likely to forgive small flaws in your credit report or your business’s financial history.

Think of your personal background statement like a professional resume. It should include your educational degrees, any relevant professional licenses or skills, and work experiences you had before starting your business.

Similarly, your business background statement should detail the history of your business and synopsize where it stands today. Include when and how you formally incorporated your business, your initial and current product lines, number of employees, gross sales, revenue, profit margins, and more. This is your opportunity to market your business to your lender, so approach it thoughtfully.

Polish up your business plan

Lenders may request an updated business plan that offers a current overview of the following categories:

The historic structure of your business: Describe how and when your business got started; your past products, vendors, and cost of goods; your net revenues broken up by product type; your number of employees, when they were hired, and total payroll; and an analysis of your historical cash flow.The competitive structure of your market: List your primary competitors with a brief description of their businesses and explain how your product or business stands out from the competition.Your projected business plan: Talk about what’s next for your business, how you plan to use the funds from your loan, and—most importantly for your lender—how you will increase revenue in order to make loan payments on time, every time.

If you’ve never written a formal plan for your business and aren’t sure where to start, the U.S. Small Business Administration offers an excellent guide that can walk you through the process.

Complete your application

If you’ve properly completed the steps above, this should be the easy part. Work with your lender or a certified loan broker to complete the application for your chosen loan product. You’ll be asked for basic identity information about yourself and your business, and then all additional information should be easily accessible from the documents you’ve prepared. As long as you’ve prepared adequately, the average online loan application should take under an hour to complete.

Read the fine print

Before you commit to anything, it is absolutely critical that you understand the terms of the loan agreement. Read every piece of the fine print very carefully before signing, paying special attention to terms relating to the Annual Percentage Rate (APR), late payment or prepayment penalties, and any terms that may allow for changes in the interest rate or acceleration of the due dates for payments.

The loan agreement that you sign is legally binding even if you don’t fully understand the terms, so if you’re not entirely comfortable, consider seeking legal counsel before moving forward.

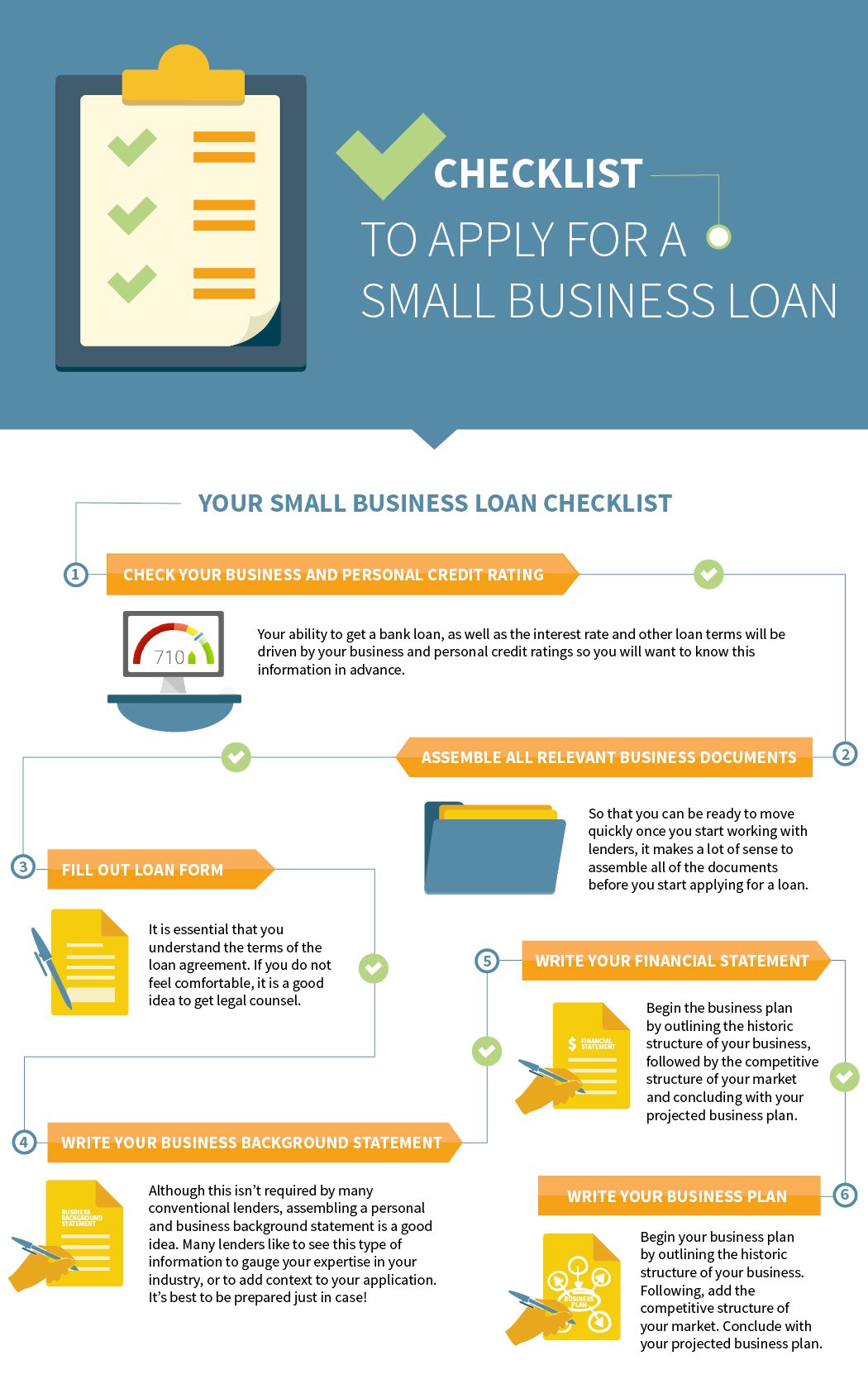

And for you visual learners out there, here is a great infographic from Fundera with a checklist for applying for a small business loan:

Source: Fundera

Choosing a traditional loan

With the tremendous growth of alternative lending products on the market, there are a variety of options for small business owners to choose from. But for those that qualify, traditional bank loans continue to be the most attractive choice, as they remain the lowest-cost product on the market.

Should you apply with the bank where you currently hold your business accounts, with another local community bank or with a large corporate establishment?

Will you apply for a traditional term loan, a business line of credit, or a U.S. Small Business Administration-backed 7(a) loan? There’s no way around it: You’ll have to do your research to determine the best fit for your business’s needs and qualifications.

Generally speaking, it is almost always best to start with the bank with whom you already have a relationship. However, keep in mind that community banks are a lot more small-business-friendly than large banks. If you have a choice, start small.

In terms of the best product, this might be a better question for your banker. For example, a line of credit could be the right choice if you don’t necessarily need a lump sum right now, but you’d like to have a financial security blanket.

Get a leg up by offering a repayment strategy

Traditional banks are redoubling their efforts to provide financing to small business owners, and they do genuinely want to see you succeed. But ultimately, the job of each and every bank loan officer is to determine how likely you are to consistently and completely make on-time payments on principal plus interest for your borrowing amount, each and every payment period, for the life of your loan.

Prove your long-term viability and help your application stand apart from the pack by preparing a forecasting document to demonstrate your repayment strategy. Talk to a business mentor in your field and use past income statements to come up with a realistic revenue forecast and cash flow projections for the next one to three years of your business. This way, you do the work for them of proving that you’ll have enough cash on hand after you’ve paid other expenses to also make your loan payments.

Searching for the best business loans online: Facts you should know

If you’ve run a quick Google search anytime recently for “small business loans,” the results you found likely didn’t come from Bank of America, Wells Fargo, or any of the traditional corporate banking giants that may have initially come to mind. Instead, you probably encountered brands like Kabbage, LendingTree, and Funding Circle—all top names in the growing alternative lending market that have quickly taken over the small business financing space.

But what exactly is alternative lending? Are these brands trustworthy and legitimate? And what can they offer you that your local community bank can’t? To answer all of these questions and more, let’s walk through the things you need to know before you begin your search for online business loans.

If you have less than stellar credit, you’ll still have options

For years, a business owner’s personal credit score has been the single deciding factor dictating the traditional bank lender’s approval process. Particularly since the 2008 financial crisis, when traditional banks tightened up already stringent small business lending standards, owners without a nearly perfect credit history didn’t stand a chance of being approved for a small business loan.

Thanks to more complex digital algorithms that can weigh a wider array of financial information, alternative lenders are far less dependent on the credit score to determine a borrower’s business loan eligibility. While credit history is still important, factors like time in business, cash flow, annual revenue, and even future financial forecasts also impact a business owner’s eligibility.

Small business owners with below-average credit scores may have more limited borrowing options or pay slightly higher interest rates with alternative lenders than they otherwise would—but thanks to the new underwriting methods of the alternative lending market, they are more likely to have some options available.

But if you have good credit, you’re in even better shape

According to a recent Wall Street Journal article, traditional bank lending tends to serve companies that have been running for 10 years or more. Younger businesses, including startups, find it very difficult to even qualify for a traditional bank small business loan. If you are a new business with no history of financial statements and revenue documentation, you are likely to get the “high risk” label, simply because you don’t have a business credit history yet.

A growing number of alternative lenders now offer start-up loans that ask for minimal, if any, business credit history to qualify. In these cases, your personal credit history takes the center stage. You can expect to pay a higher rate and have your personal credit closely scrutinized. Startups and fledgling businesses may qualify for working capital loans, equipment loans, lines of credit, professional practice loans, and franchise startup loans through alternative lenders.

There’s a small-business loan for every need

Stepping beyond the limited offerings of traditional banks, alternative lenders have introduced a wide range of business loan products to meet the varying needs of borrowers. Taking into consideration your use of funds and your desired repayment timeline, a knowledgeable loan broker can help guide you to the right loan product at the right price.

For seasonal business owners facing unpredictable cash flows, short-term loans offer capital to purchase inventory before the busy season, while merchant cash advances allow for a flexible repayment structure proportioned to the business’s daily credit card sales.

For business owners unable to put up collateral, self-collateralizing equipment, or invoice financing can make necessary capital available without the need for a personal guarantee. With every new hurdle presented by business borrowers, the alternative lending marketplace has been quick to innovate accompanying solutions.

Pricing structures will vary

When working with an alternative lender, it’s important to note that pricing structures between alternative loan products aren’t as standardized as they are in the traditional lending market. Different lenders and different products may state interest rates in different ways, meaning that a direct comparison of two different percentages may not give you a full picture of the difference in cost between the two loans.

For example, instead of the typical monthly repayment schedule of a traditional term loan, short-term loans through alternative lenders often have a daily or weekly amortization period (i.e. the frequency that interest compounds and that loan repayments are due). As a result of that more frequently compounding interest, a 20 percent interest rate (sometimes called a factor rate) on a short-term loan can often result in costs more in line with what would be a 35-40 percent interest rate on a traditional term loan.

To make sure you’re comparing apples to apples, always ask the lender for the loan’s annual percentage rate (APR), or calculate it for yourself using an online APR calculator. Regardless of any loan’s specific terms, evaluating the APR will give you a clear, standardized picture of your true cost of borrowing.

In general, you’ll find applying for a small business loan fast and easy online

Compared to the extensive paperwork and weeks- or months-long underwriting processes involved when applying for a traditional bank loan, online alternative lenders have streamlined the application process to make it much faster and easier.

With many alternative lenders, business owners can apply for a business loan online in less than an hour and be notified of approval within one business day. This is a major relief for businesses needing quick access to capital in order to manage daily expenses or take advantage of new business opportunities!

Less regulation means you need more education

Unlike traditional banks which are still beholding to FDIC regulations, the alternative lending industry is still almost entirely self-regulated. In some ways, this is a benefit to borrowers, as less regulation allows for more innovation in loan products and terms. And for the most part, the desire for legitimacy has led most alternative lenders to protect consumer best interest with their practices.

That said, lack of federal regulation does mean that borrowers have to be smart and do their research when choosing lenders and shopping for loan products.

Investigate the lender’s reputation and make sure they are a legitimate business before working with them and shop around with multiple lenders in order to compare pricing. If you’re uncertain, work with a quality loan broker to make sure you’re getting a good deal.

You can borrow appropriate amounts

Most traditional banks won’t consider making a loan for less than $250,000. This can be useless for a small business that just needs $60,000 to buy the next big piece of equipment or hire their next team member—or $5,000 for a machine or some seasonal help.

Online lenders fund loans in amounts needed by small businesses. They can easily process loans between $5,000 and $250,000. In general, online business loans provide more flexibility in loan products and terms for small-business owners.

That means you won’t be restricted to only the most conventional borrowing options out there. Instead, you’ll have access to a variety of online business loans for many different purposes at appropriate amounts for your business.

Convenience does come at a cost

Compared to small-business owners, big business counterparts typically have more experience, resources, time, and human capital to weather the lengthy process required by traditional banks. Big businesses are also a more viable customer for a bank because the size of their lending needs, and all things being equal, for the same amount of work, the bank makes more on a larger loan for the same amount of work.

Alternative and online lenders recognize that. With that in mind, they have developed lending programs that provide small businesses with what they need and cut out what they don’t. Alternative and online lenders have a willingness for the higher risk that comes with working with small businesses. And that customization, convenience, and risk, like all things in business and in life, come at a cost. In part, online loans are more expensive in part because they’re so accessible.

Alternative lenders expand access to credit for small businesses, but to do so, they take on riskier borrowers. Unfortunately, if you have a less-than-stellar credit score or you’re just starting out, funding your small business is viewed a risky investment. To minimize their losses, online lenders charge high-interest rates and fees.

Minority small business loans: Your 6 best options

Historically, minority business owners have faced more challenges in securing financing. But the financing landscape for small businesses is changing, meaning new opportunities and a broader range of minority business loans are available.

Typically, lenders define minorities as African-American, Hispanic-American, Asian-American, Alaskan Native, Pacific Islander, or American Indian individuals. A business is classified as minority-owned if 51 percent or more is owned by a member of one of these groups. To qualify for a minority loan application, your business must be certified as a minority business enterprise (MBE) or disadvantaged business enterprise (DBE).

Understand eligibility nuances

Minority business owners who take the time to understand the nuances of the eligibility requirements will have the best chances of success in getting approved for a loan. That said, the guidelines are not necessarily straightforward, and lenders are not known for being especially transparent. But with some research and due diligence, you can find your way.

As a minority small business owner, you may face unique circumstances such as starting a business in an underserved area, being economically challenged, or seeking a smaller-than-average loan. That doesn’t have to be a showstopper, though; it just means you may need some extra guidance on where to look. Some federal, state, local, and private loan programs are tailored to address these specifics.

For that reason, it can be advantageous to work with a local organization that knows the nuances of your market and can help you find your best match for lending, enabling you to learn about ultra-niche programs. For example, WESST is a nonprofit organization dedicated to assisting small business owners in New Mexico.

To complicate things further, many geographically-specific organizations also have special niches, which can make researching the best minority business loans for your needs a lengthy process.

The following resources should help you get a head start:

1. National Minority Supplier Development Council

The National Minority Supplier Development Council, or NMSDC, helps minority-owned businesses get their certification as a Minority Business Enterprise (MBE), which in turn, helps them become eligible for minority financing programs.

Once certified, the NMSDC connects minority business owners to contracting opportunities with its extensive network of corporate partners. As an MBE-certified member, when you establish a supplier and/or vendor relationship with one of the NMSDC’s national or regional corporate members, you expand your pool of possibilities for financing.

With these certifications and relationships in place, you will have more direct access working capital loans, as well as specialized and long-term financing through the NMSDC’s partners. Although there are a few steps to the process, this is a solid source for minority business loans.

2. National Minority Business Council

The National Minority Business Council’s (NMBC) goal is to expand opportunities for small, minority, and women business owners. The organization provides business assistance, educational opportunities, seminars, purchasing listings, and related services to businesses across the United States.

3. The U.S. Department of Commerce’s Minority Business Development Agency

Minority-owned businesses that are looking to expand into new domestic and global markets can access business expertise at an MBDA Business Center. MBDA Business Centers help minority small business owners start and grow their companies by securing capital, competing for contracts, identifying strategic partners, and enhancing their expertise through education and mentoring.

Strategically located in areas with large concentrations of minority businesses, the centers are staffed by specialists with the knowledge and practical experience needed to run successful and profitable businesses. Business referral services are provided free of charge.

5. Small Business Administration 8(a) Certification Program

This federally-funded initiative helps minority-owned small businesses attract more clients, projects, and revenue by getting them a foothold in government contracting.

The SBA’s 8(a) Business Development Program offers specialized business training, counseling, marketing assistance, and high-level executive development. In addition, you can access surplus government property and supplies, SBA-guaranteed loans, and help in building your competitive and institutional knowledge and skills.

Another facet is the 8(a) BD Mentor-Protégé Program, which pairs young companies with more experienced counterparts to accelerate and facilitate learning.

6. Union Bank

Union Bank provides specialized loans and lines of credit of up to $2.5 million for companies who meet the bank’s definition of a minority-owned business. Union Bank’s definition is the same as the EEOC’s, and its offerings have eased lending standards, simplifying the process and qualifications for new businesses who need financing.

These organizations offer the cornerstone of successful businesses—people and information. While they can direct you to minority business loans, these organizations can also make introductions, help you prepare a winning loan application, and get expertise on running your business successfully.

10 Small business administration loans to consider

Contrary to what the commonly used term “SBA loan” suggests, the U.S. Small Business Administration itself does not directly lend money to businesses. Instead, the SBA’s role is to “guarantee” a percentage of loans provided through SBA-approved intermediary lenders, reducing the lender’s risk and in turn incentivizing them to offer loans to small businesses.

Here’s a list of the different types of SBA loans available:

The 7(a) Loan Program

The vast majority of small businesses that borrow money through the SBA do so through what’s called the 7(a) Loan Program. Through this very generalized term loan program, borrowers can obtain up to $5 million for nearly any business purpose. Loans for general working capital or the purchase of equipment, fixtures, or inventory are available for five- to 10-year terms, while loans for real estate or construction projects may be available for up to 25-year terms.

To qualify for a 7(a) loan through the SBA, you must be a for-profit business and be able to show good character, sound financial management, and a clear ability to repay the debt.

Along with the benefits of improved cash flow and an up to 85 percent guaranty on the loan amount (75 percent for loans greater than $150,000), borrowers through the 7(a) loan program benefit from some of the best interest rates on the market. Under the administration’s preset limits, the absolute maximum cost of any loan through the 7(a) program is prime plus 4.75 percent—with even lower maximums for loans fitting certain conditions.

Under the larger umbrella of the 7(a) loan program, the SBA offers several related programs designed for more specialized circumstances. Before moving forward with a general SBA 7(a) loan application, consider whether your borrowing needs may be a better fit for one of these programs.

SBAExpress

Historically, one of the major downsides of SBA loan programs, in general, has been the far longer than average turnaround time for approval. After all, for business owners who need immediate access to working capital, a weeks- or months-long underwriting process can be crippling.

The solution? SBAExpress—a streamlined 7(a) program alternative for loans up to $350,000. SBAExpress loans can be obtained as a revolving line of credit for a period of up to seven years maturity, or as a traditional term loan under the same conditions as the generalized 7(a) loan.

There are some downsides to SBAExpress: It offers only a 50 percent guaranty on the loan amount (compared with up to 85 percent on general 7(a) loans), and for loans under $50,000, the SBA’s preset maximum interest rate escalates to prime plus 6.5 percent. Yet, for business owners unwilling or unable to wait through a long underwriting process, the pros clearly outweigh the cons.

CapLines

The SBA CapLines program is essentially the 7(a) program’s line of credit option. Through this program, lines of credit—including revolving lines in some cases—are available for up to $5 million for up to 10-year terms to help small businesses meet their short-term and cyclical working capital needs.

Terms for financing through the CapLines program are nearly identical to the 7(a) loan program, including the same percent of guarantee, maximum interest rate on a business loan, and fees. But for borrowers who prefer the flexibility of a line of credit over a lump sum term loan, it’s an alternative worth considering.

Community Advantage

Designed specifically for small-business owners who have historically been underserved by traditional banks, SBA Community Advantage loans are a fraction of the 7(a) loan program offered through over 100 local community advantage lenders around the country.

Available for loan amounts of $50,000-$250,000, these loans hold the same terms as traditional 7(a) loans with regard to maturity, percent of guaranty, and guaranty fees. However, because of the perceived higher financial risk of borrowers through the Community Advantage program, the SBA’s maximum interest rate for loans through this program is set to prime plus 6 percent—a slight increase as compared with other 7(a) loans.

Export Working Capital Program

When customers are thousands of miles away and operating in a foreign currency, maintaining strong company cash flow can prove particularly difficult. Even so, the exporting of goods is critical to the U.S. economy, meaning the SBA has special incentive to help exporters finance their businesses.

That’s exactly the purpose of the Export Working Capital Program, which offers a 90 percent guaranty on short-term working capital loans of up to $5 million for exporters. These loans carry the same guaranty fees and qualification standards as 7(a) loans but generally have a maturity of one year or less. While this is the only SBA loan program with no maximum interest rate cap, the SBA does monitor for unreasonable rates.

ExportExpress

Think of ExportExpress as the SBAExpress version of the Export Working Capital Program. ExportExpress serves the same purpose and market as the Export Working Capital program, but also offers the same streamlined process and fast turnaround times enjoyed by SBAExpress applicants.

You can obtain an ExportExpress loan for up to $500,000 with all the same maturity terms, interest rates, and fees as you would find through the SBAExpress program. But as an added incentive, ExportExpress includes a 90 percent guaranty for loans of $350,000 or less and a 75 percent guaranty for loans greater than $350,000. This reduction of risk is a benefit to lenders and borrowers alike!

International trade

Mirroring the goals and certain terms of the Export Working Capital Program, the International Trade loan program offers term loans of up to $5 million and 25 years’ maturity for borrowers who are preparing to engage in international trade or who are adversely affected by competition from imports.

International trade loans come with a 90 percent guaranty, along with the same interest rates and guarantee fees as general loans from the 7(a) program. This long-term, low-cost, and highly guaranteed form of financing is ideal for businesses looking to compete more effectively in the international marketplace.

SBA Veterans Advantage

Having already honed the skills on the battlefield that they need to succeed as business owners, active service, reserve, National Guard, and veterans of our military have historically been some of our nation’s most successful entrepreneurs. In recent years, though, access to funding has too often held these servicemen and women back from achieving their business goals.

To solve this problem, the SBA added the Veterans Advantage loan to its lineup of 7(a) loan programs. This program follows all the same terms as traditional 7(a) loans, but is available only to small businesses owned and at least 51 percent controlled by veterans, active duty military in TAP, reservist, or National Guard members, or the spouses of any of these groups—or to widowed spouses of a service members or veterans who died during service.

The CDC/504 loan program

One of the most complicated financing products on the market, loans provided through the SBA’s CDC/504 program are typically used to finance the purchase major fixed assets like equipment and commercial real estate. Funding may be available for up to $5.5 million for terms of up to 20 years, but exact terms of these loans vary widely by project.

The most notable feature of CDC/504 loans is that they’re actually funded by two different entities—one being the lender; the other being an SBA-licensed Certified Development Company (CDC). Because of this complex structure, borrowers often won’t know the exact interest rate on their loan until up to 45 days after the project has funded. Given these complications, it’s easy to see why CDC/504 is the least commonly used of the SBA’s loan programs.

The Microloan program

For some entrepreneurs, just a small amount of capital has the potential to go a long way towards a business’s growth goals. Yet, from a traditional lender’s perspective, business loans for under $50,000 aren’t worth the risk or effort to fund. It’s precisely for this reason that the SBA Microloan program was created.

Under the Microloan program, borrowers seeking between $500 and $50,000 for working capital, supplies, machinery and equipment, fixtures, or similar business needs work with nonprofit intermediary lenders to obtain fixed-rate financing. Along with the funding, these nonprofit intermediaries frequently offer business mentoring or technical assistance to help borrowers achieve their business goals. Interest rates and terms are negotiable with the intermediary lender, but they typically cap at 8.5 percent APR and a maximum of six years maturity.

Fees to watch out for with EVERY business loan

To save you some headache and help you determine the true cost of borrowing as you shop for a loan, let’s break down the different fees that could be associated with your small business loan.

Origination fee

An origination fee is used to mitigate costs for financial institutions. You will not pay this, however, unless you officially take the loan from the lender. This fee can either be listed as a flat dollar amount or as a percentage of the principal.

Keep in mind, though, that not all lenders charge an origination fee and those that do, vary in cost. Check with your individual lender to ask about any origination fees that may be associated with your loan. In the end, it might make one lender more expensive than another.

Guarantee fee

Guarantee fees are most often associated with SBA loans. The good news for borrowers is that because of this guarantee, lenders are more lenient with approving loans for small business owners who have less cash flow or less established credit.However, the SBA assesses a guarantee fee that is charged to the lender, who may choose to pass it along to you at closing.

The guarantee fee is based upon the maturity of the loan and the dollar amount guaranteed, not on the total amount of the loan. This can be a bit confusing to calculate, so if you’re applying for an SBA loan, ask your lender to break down any guarantee fees you’ll incur and how they will impact your total loan cost.

Check processing fee

As a means to keep their rates low, lenders will directly connect to your bank account and automatically process your monthly loan payments. If you’d rather pay by check, your lender may charge a check processing fee to cover added costs.

Late payment fee

It’s never a good idea to miss a payment. Not only does it hurt your credit score—it will also end up costing you more in the long run. To account for unexpected events, some lenders will offer a grace period. Just try not to turn that grace period into a habit.

Missed payments come with late payment fees, so to avoid it, make your loan payments on time.

Pre-payment fee

In theory, paying your loan off early seems like a good decision. You’d no longer have that debt hanging over your head, and you could save some money on the interest rate, right?

Be careful, though. Depending on your loan agreement, you could face a penalty charge for doing so. This fee could potentially cost you more than the interest saved, so it’s best to do the math beforehand.

If you can, try avoiding small-business loans that have prepayment penalties, as these penalties could prevent you from refinancing your loan in the future (or just paying it off completely, if that’s your plan). If you want to leave your options open, look for a small business loan that doesn’t come with these fees.

Account for fees and differing interest rates with effective APR

Accounting for all the fees that may be associated with your loan will help you to determine your true cost of borrowing. While keeping track of these different fees can be complicated, you can get a solid idea of your total cost of borrowing by asking your lender for the loan’s annual percentage rate.

The APR will tell you the true cost of borrowing, showing you not only your monthly payments but also the total cost of your loan throughout the course of a year. And because the APR takes into account different interest compounding rates and includes any fees that are associated with the loan, you can compare the APR of various loan products and know that you’re comparing apples to apples.

Some lenders don’t advertise the APR on their loans outright, but they’ll usually provide it if you ask. And if they don’t, you can always use an APR calculator to determine your true cost of borrowing.

The best small business loans are the ones that give more than they take

Regardless of how you go about obtaining working capital for your business, take the time to research your options, review the terms, and read the fine print to make sure you’re getting the best deal available to you. You also want to forecast your repayment and financial projections accurately, and make payments on time. When you do this, a loan option may be a good solution to keeping your working capital working for you.