New technologies create excitement within small business communities across the U.S. The opportunity to move one's business online is the dream of almost every entrepreneur who has a viable product to sell, and why not? They can benefit from lower overhead costs, which means more of their revenue goes directly into their pockets in the form of profits.

If you're selling your company's merchandise online, you must protect your customers as well as your business. It's up to you to guard all applicable parties from the rogue elements that troll the internet looking for opportunities to steal money and information. Are you doing enough to protect your business?

If you want to transact business online, you must have protections in place. Here are five ways you can protect your ecommerce business from fraud.

1. Monitor business transactions daily

You're the only person who knows your business and your customers. You have probably come to realize there are certain aspects of your business that are somewhat predictable. If you will take the time to review your receipts and transaction records every day, you will find it easier to identify potential dubious transactions. The sooner you can find them, the easier it will be to fix them and prevent similar issues in the future.

2. Shore up your business password

Internet fraudsters are devious criminals. They use their incredible computer skills to take advantage of people who don't know how to protect themselves. Their favorite targets for information are user passwords. They have tools that can decipher a six-digit password in just minutes. To make your password as strong as possible, you should use an eight-character or more alphanumeric password with at least one capitalized character and one special character.

3. Use available verification options

As part of your payment processing platform, you should have several security options you can use to prevent fraudulent transactions.

The two primary options that should be of interest to you are the Address Verification System (AVS) and Card Verification Value (CVV). By using these features, you'll be able to quickly weed out fraudulent attempts to use credit cards. If your payment processing platform doesn't offer these security options, you might consider making a change.

4. Set limits on transactions

As a rule of thumb, the larger the transaction, the higher the risk. If you set limits on the size and number of transactions a single customer can make in a day, you will limit your exposure to fraud. This is an option you can usually customize by the customer, allowing you the ability to offer higher limits on established relationships.

Keep track of every important detail with Keap Pro. Get a tool that houses all your client activity and communications in one place. Try us for free for 14 days at the link 👉 https://t.co/b9iufh98rl pic.twitter.com/XmCMR8rmkn

— Keap (@KeapGrowing) July 5, 2020

5. Update your software

Each generation of software comes with updated security features. You need to make sure you're using the latest and greatest software programs at all times. The price you will pay in upgrade costs will be recouped through lower incidences of fraud.

Before you go ...

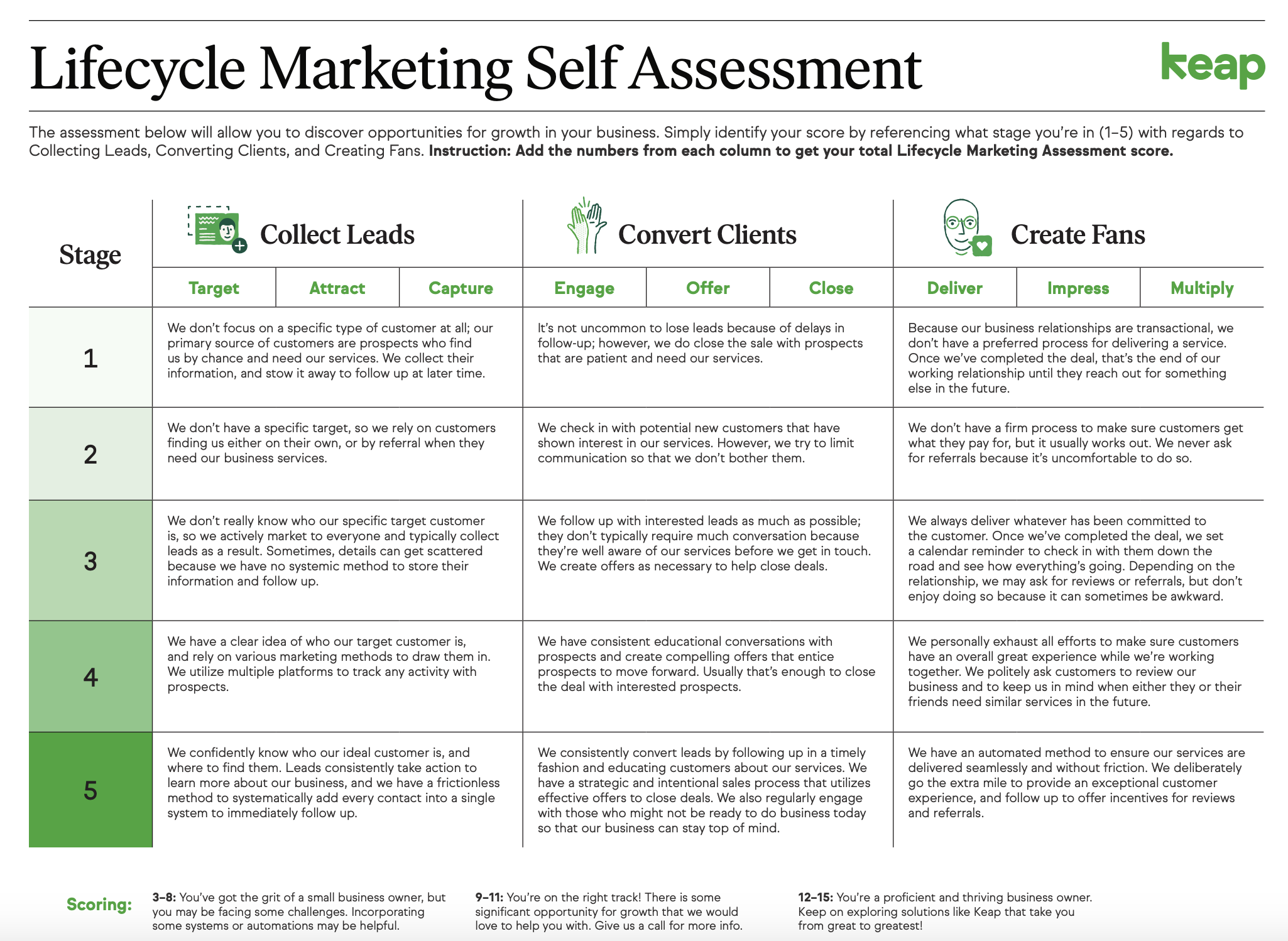

SEE HOW YOU RANK: Take Keap's Lifecycle Automation Self Assessment and compare your business against the industry’s top performers with our proven formula and instantly reveal the strengths and gaps of your business.