Small business credit cards are indispensable resources for managing procurement for many small businesses today.

Credit cards help you manage your expenses against your cash flow, and they make it easy to make purchases for the business on the spot. Most small business credit cards offer perks and rewards that can add value to your business. Handled the right way, they can improve your company’s business credit rating. And if those reasons weren’t enough, many vendors prefer credit card payments, too.

But small business credit cards are not without risks. If you mishandle your company credit card, you could run into some real trouble. It’s tempting to buy everything up-front rather than waiting until you can afford it, which could leave you in deep debt. Even the best business credit cards aren’t covered by the same consumer protections as personal credit cards, which could increase your risk. Like credit cards can help your credit rating, mishandled credit cards can damage it— and with small business credit cards, bad credit habits can have tax implications (failing to keep receipts, commingling funds, etc.).

Not to mention, credit card interest is an expense that serves the bank—not your business. Handle your small business credit card right, and it gives you more flexibility in your business. Handle it wrong, and it can be a liability.

In this comprehensive guide, you’ll learn when are the right times to use small business credit cards, what is the best business credit card for small business, and best practices for managing your credit card.

4 times where using a credit card may be the right choice

As any veteran small-business owner can tell you, sometimes stuff just happens. Equipment breaks. Customers don’t pay on time. Or maybe the business is booming and has the expense of expansion. Whatever the scenario, money is a necessity in business, and if a company is unable to cover these expenses out of pocket, they’re faced with the decision of taking out a loan or putting purchases on a business credit card.Sometimes, opening a small business credit card could be just the solution an entrepreneur needs to finance their business. Here are four situations in which a credit card may be the right financing choice for your business.

1. When you need funding fast

Let’s say you're in the T-shirt design business and you just received a large, unexpected order that requires more T-shirts than you currently have on hand. If you want to fulfill the order, you're going to need extra cash—and fast.

You could go through your local bank for a small business loan—but since it takes anywhere from several weeks to months to get approved, it’s likely you won’t get the money you need in time to complete your order.Getting a business credit card is an incredibly quick process. If you need the funding fast, a credit card might be the best way to get it done.

2. When you can take advantage of zero percent introductory APR

When you’re shopping around for the best small business credit cards, you may notice a few that are offering a zero percent APR on purchases and/or balance transfers for an extended period of time. The zero percent APR introductory offer would be a great financing option if you’re using the card to buy something that won’t increase your immediate cash flow (like replacing broken equipment, for example), and you’d be unable to repay the card’s balance in full by the end of the month.

However, it’s important to remember the introductory period won’t last forever, and often the increased interest rate at the end of the introductory period can be extreme. Having zero percent APR can make it too easy to get carried away with overspending, so be careful not to accumulate so much debt that you won’t be able to pay it off before that higher interest rate kicks in.

3. When the credit card’s APR is less than your loan offer

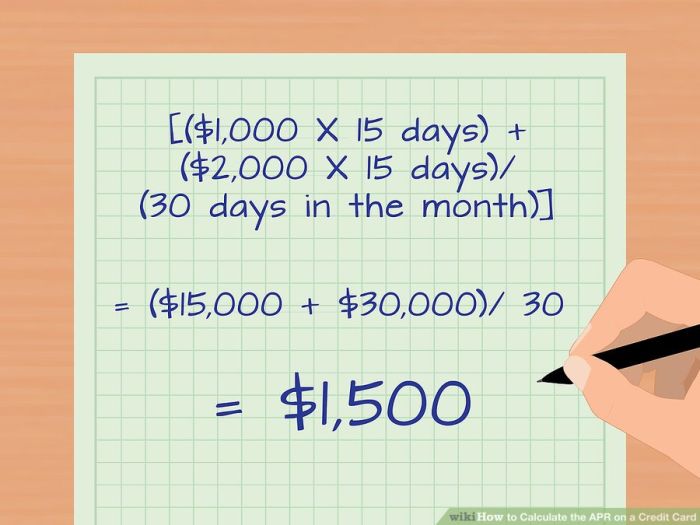

Whenever you’re looking to borrow money, it’s important to weigh the pros and cons of your choices, and one of the best ways to do so is by calculating the APR of each.

Whether you’re looking to get a loan through your local bank or an online lender, or you’re looking to open a business credit card—calculating the APR will help you determine your monthly payments, interest and other fees, showing you the total cost of borrowing for each of your options.

A bank loan will almost certainly be cheaper than a credit card, but with an online loan offer, the APR might be higher than your credit card. If this is the case, it might be better to stick with a credit card to finance your business.

4. When the credit card’s APR is irrelevant

Keep in mind that while it may seem obvious to always choose the lowest cost option, it only makes sense if it meets your business’s needs.

Let’s take the T-shirt designer scenario as an example, and let’s say you’re planning to pay off your debt as soon as you get paid for the large order. If you used a credit card and completely pay off the balance by the end of the month, you won’t be charged any interest. That means the cost of borrowing would effectively be free.

On the other hand, if you went through an online lender for a loan, you may be subject to prepayment penalties, which would void any savings you could have incurred from early payment.Of course, like any loan option, each business credit card comes with different terms. Some have a spending limit, while others do not, and many small business credit cards come with rewards. If you do decide to use a credit card to finance your business, make sure the card you choose meets your personal and business needs.

How to find the best small business credit cards

Small business credit cards come with what can seem like an endless variety of perks: cash back, airline miles, hotel points, special travel upgrades, a host of discounts—the list goes on and on. Along with the fun and exciting perks come more practical benefits—things like low introductory APRs, reduced fees, or special rates for balance transfers.

Like all good things, though, these benefits come with a degree of consumer responsibility.

You owe it to yourself to not just seek easy business credit cards, but the best business credit card for you. This means thoroughly researching your options, and carefully choosing the card that best fits your financial situation and gives you fun perks that you will actually use.

Before you commit to a credit card for your small business, answer these questions to make sure you’re making the best choice.

1. What do you need?

Consider your short, medium, and long-term financing needs. If you’re just starting out and need to establish credit, a secured credit card may be the way to go in order to track monthly expenses in one spot and get some credit on the books.

Or, if there’s a high-priced piece of equipment or machinery that you need to buy soon, you may be a better candidate for a credit card that doubles as a small business loan vehicle. In this case, a card with a zero percent APR for a generous period may suit you well. It’s good to know your goals so that you can direct your search and select offers that match your needs.

2. What will your monthly balance be?

Do you plan to pay off existing debt and use the card as an “emergency only” medium, or are you more likely to float cash from month to month to cover the cost of doing business? Whichever the case, you’ll want to figure out a range of what your ongoing balance will be, as well as whether you will be paying it off monthly or not.

Keep in mind that one of the things the credit bureaus look at to assess your creditworthiness is your monthly balance. This is an indicator of how much lending you can qualify for in the future. Keeping a balance every month can affect your debt ratio—even if you pay the monthly minimum. This is good to keep in mind as you evaluate the many options for small business credit cards out there.

3. Did you read the fine print?

It’s impossible to understate the importance of reading the fine print in a credit card contract. An introductory APR offer or zero percent balance transfer can be a great asset to your business—but you need to watch out for hidden fees.

You should ask questions about when the balance of a big-ticket purchase or high-dollar transfer is due. In addition to watching for transaction fees on the up-front purchase, you also want to be aware of the date that the interest rate on the purchase increases.

Also, remember that it’s common for credit card companies to apply penalty fees and increased interest rates if you make a late payment.

4. What’s your rate?

When you sign up for a new credit card, you should always know your interest rate and the factors that may cause it to fluctuate. As you shop around, you will see cards at higher and lower rates. It’s important to consider the rates along with your planned usage of the card, plus other fees including transaction fees, annual fees, and other benefits.

5. When will you pay the card balance off?

Whether you plan to pay off your credit card monthly, or more—or even less—often, we suggest you commit to a payoff plan in advance. You should also build in contingencies, which will lessen stress in the unknown.

6. What kind of rewards do you want?

Weigh the benefits of cash back, travel perks, points toward retail purchases, and the other offers out there on the market. Do keep in mind that travel, retail, and points rewards do come with expiration dates, so really think through what you will actually use. You don’t want the disappointment of moving your finances around in order to accumulate points if you eventually can’t use them.

Best practices for managing small business credit cards

In order to reap the benefits and reduce the risks of small business credit cards, follow these best practices:

Pay your full balance

Most small business credit cards allow you zero interest as long as you maintain a zero balance each month. The day you allow your business to carry a balance is the day you start paying interest. It can also make it harder to pay down the balance next month, which could lead to a slippery slope of growing credit card debt. And as you learned in the first section of this guide, credit card debt can affect you in numerous ways.

Pay on time

Miss the payment due date, and you’ll trigger a late fee in addition to the interest. On top of that, you’ll risk your interest rate going up and a ding on your credit.

The remedy is to be organized.

Don’t let your bills build up. Instead, establish a rhythm for paying bills. For example, designate every even-numbered Friday as a payday for any outstanding bills.

Do not commingle funds

As a business owner—especially if you’re a sole proprietorship—it can be tempting to use your business credit card for personal purchases. Commingling business and personal funds has the potential to negatively impact contracts and grants, cross ethical boundaries, make tax reporting difficult, or in some cases, may even be against the law. It’s sound business practice to avoid commingling funds altogether.

Keep it secure

With all the other things on your plate, do you really want to deal with credit card fraud, too? When not in use, be sure to keep your small business credit card in a secure location. While it seems obvious, it’s easy to forget that physical security of your office is important.

If you have employees that require a credit card for work, the best practice is to provide each person an individual card. Everyone else should never touch one. That way you can track exactly where misuse is occurring. Of course, that’s not perfectly practical for every small business. So be smart. Don’t make it easy for others in your office space to access the credit card without explicit permission, and make sure that they promptly return it.

Have a policy for when to use cash vs. credit

The best way to avoid overspending on your credit card is to have a plan. You don’t always need to use your credit card. You can pay from your business checking account or petty cash. Strategize what will work for your business and establish how you and your staff will know the rules.

Experts including Dave Ramsey of EntreLeadership recommend that small businesses stay debt-free. This means never using a credit card, but instead sticking to cash. While that can work for some, it won’t necessarily work for all businesses. However, given the risks associated with mismanaging credit cards and out-of-control business debt, it’s worth considering.

Review your statement

Unless you have a CPA on staff, statement review can be a major pain, and it can be easily overlooked. Nonetheless, statement review is one of the best ways to catch fraudulent charges. If you allow others in your business borrow the card, then it’s a must.

Go a step further: Reconcile your receipts with your statement, and file them together. This will help you stay organized for tax time.

Keep your receipts

Since we’re on the subject of receipts, remember the old adage: You can’t deduct what you can’t document. Your credit card statement alone isn’t sufficient backup for tax purposes.Don’t be lazy about retaining receipts. Have a place you file them so that they’re handy when it’s time to reconcile your statement.

Don’t overspend

Finally, the most important best practice is simple in theory, but often difficult in practice: don’t overspend.

The way to avoid overspending is to know your limits, which means creating a budget and sticking to it. To stay on top of your limits, run quarterly cash flow projections, and monitor your revenue against your projections.

This way, you can safely keep your business in the black while keeping your credit card payments under control.

The best business credit cards are assets—when combined with smart stewardship

Handled the right way, a credit card can be a huge asset to your business, adding convenience, providing procurement coverage when you need it, and helping you track expenses. And when you follow business credit card best practices, you’ll avoid the common pitfalls that have been the bane of many a small business.

Auditioning business credit card offers and reviewing their fine print is a process that pays so much more than its bonus perks. It gives you a sound foundation on which to finance and grow your business.