Give your online sales a boost using Keap’s CRM with invoicing

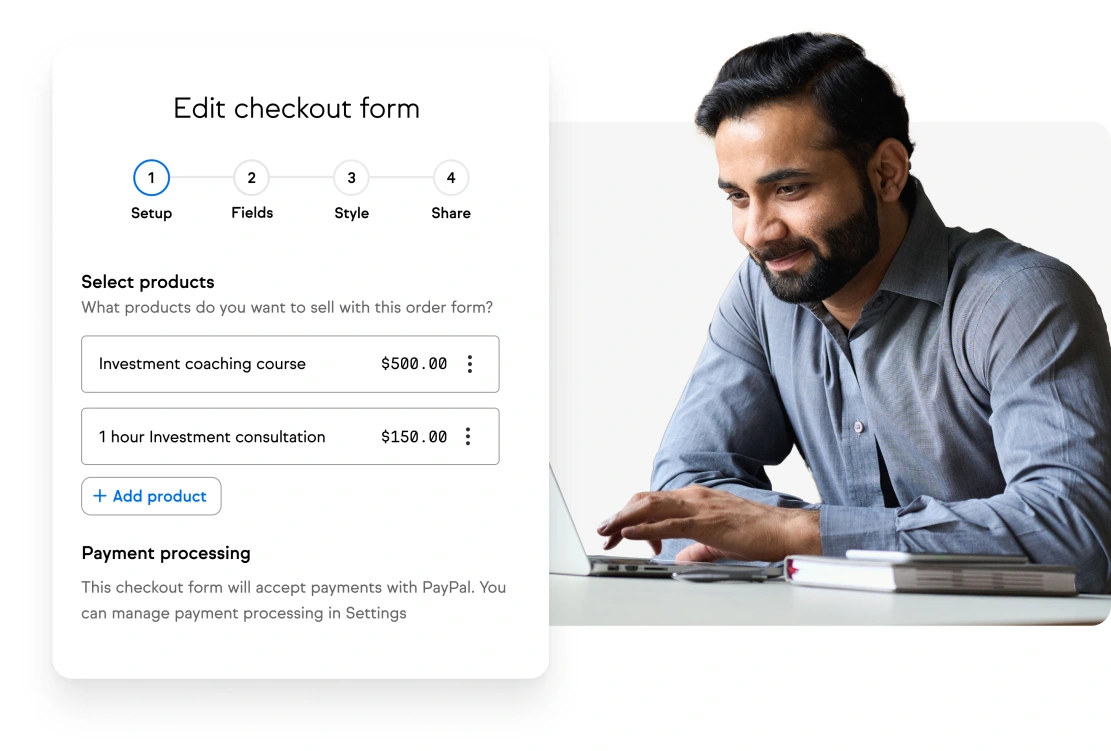

Selling online is easier than ever before for small businesses, thanks to Keap’s CRM and billing software. With Keap’s ecommerce features, invoicing, and payment processing, you can customize the software platform to your needs and avoid adding other third-party tools.

14-day free trial. No credit card required.

Push conversion rates with upsells and promos

Promo codes can create new and repeat business with the right offer at the right time. One-click upsells can push your average order value higher and maximize revenue. Between the two, your small business is about to level up.

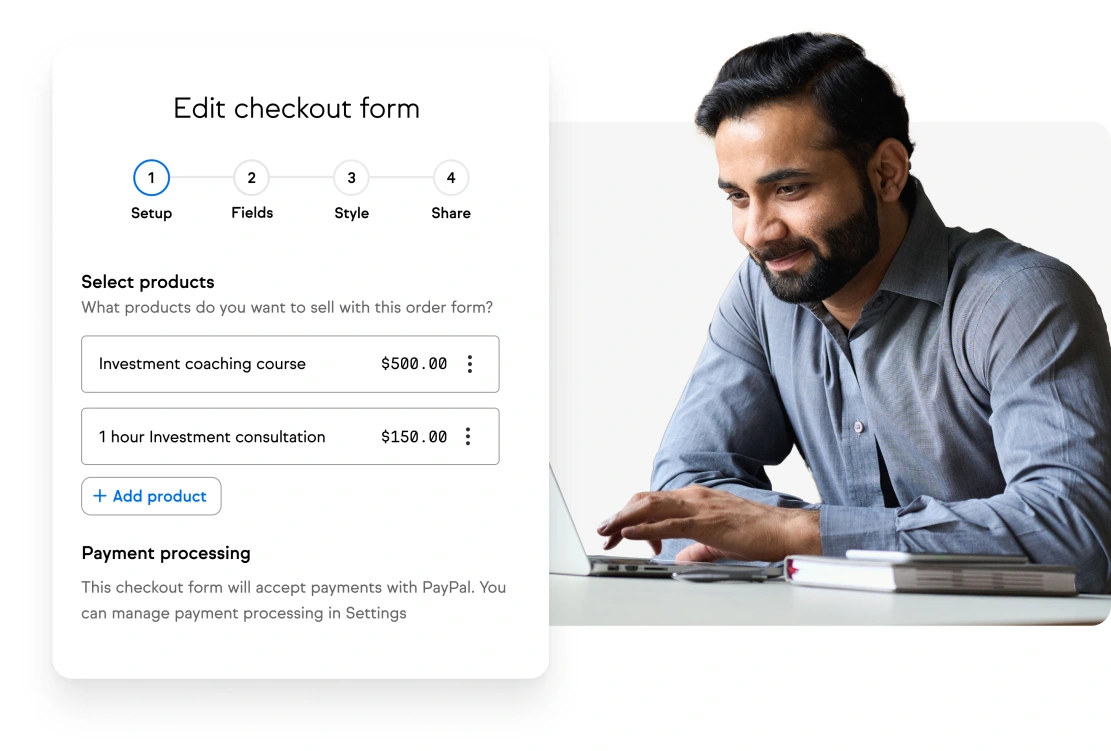

[Keap’s payments platform] has been easy to use and the addition of the pay now button on the invoices has been incredible.

Justin W. | Coaching Biz Mastery

See your sales multiply with reporting

Use Keap’s built-in sales reports to track results and gain insights into the growth drivers of your small business.

Connect your existing software tools seamlessly

Keap’s powerful CRM connects easily to all the data, apps, and devices that are behind the day-to-day operations of your business. That includes Gmail and PayPal, allowing you to trigger automations and sell more effectively.

Complete business automation for

growing small businesses

Keap helped drive $2.6B in online

sales for customers

Frequently asked questions

-

Can I send a quote directly to my customers within the software

Yes! Keap’s CRM with invoicing allows you to send a personalized quote directly to your current and prospective customers. Keap also offers the ability for customers to pay directly from the quote.

-

I need to invoice customers on a regular schedule. Can I set up automatically recurring payments?

With Keap’s CRM and billing software, you can set up recurring payments, determine payment frequency, add custom start and end dates, and pause payments when necessary. Recurring payments can be accessed in the contact record.

Read more about recurring payments in Keap here.

-

Is Keap’s CRM payment processing software a good fit for ecommerce stores?

Many ecommerce stores currently use Keap to grow. Keap’s CRM payment processing software is very capable of processing a high volume of payments and online orders, so ecommerce stores can certainly use Keap to grow their business.