Right now, if you were to choose a word to sum up the current situation for small businesses in the United States, the word to choose would be "grim." With shutdowns due to the coronavirus pandemic still keeping as many as 53% of all small businesses closed, and data indicating that at least 100,000 among them will never reopen, it's the only word that comes close to capturing the enormity of the crisis. For businesses that are still hanging on, the outlook is uncertain, at best.

That said, it's not as though small businesses haven't had to fight through adversity before. In fact, the Great Recession of 2008 hit small businesses disproportionately hard, with data showing they accounted for 62% of net job losses as the recession spread. That recent history can go a long way toward providing today's small businesses with something of a roadmap—illustrating what to expect, as well as a possible path through the economic devastation.

With that in mind, here's a deep dive into how the situation facing small businesses compares to the Great Recession of 2008, and what recovery strategies small businesses can use to make it through the current one.

A sudden and sharp drop

Back in 2008, the losses that small businesses in the U.S. would eventually suffer came with little or no warning to most. They were the result of the one-two punch of the housing market collapse and the simultaneous onset of financial peril for some of the nation's largest financial firms. Together, they had the effect of freezing credit markets, as well as decreasing liquidity for businesses and the customers they served.

For most small businesses, the result was a sudden and sharp decline in revenue, coupled with an inability to access credit or secure bridge loans to keep their lights on. Under those conditions, the outcome was inevitable—around 223,800 small businesses went under and never reopened.

Different causes, similar results

This time around, the crisis didn't stem from a sudden economic shock, but instead from a sudden need to shutter the economy to protect public health. As it turns out, that may turn out to be advantageous for businesses in some ways, and pose certain specific challenges in others. On the positive side of the ledger, the quick creation of a lending mechanism for small businesses (the Paycheck Protection Program) prevented a repeat of the worst effects of the 2008 recession, program rollout shortcomings notwithstanding. It made sure that many, if not most, small businesses had access to lifeline funding to keep their workers on the payroll and their business viable.

On the negative side, bridge funding from the PPP has become the sole source of operating capital for the vast majority of small businesses. In 2008, even as the economic fallout spread, small businesses still could make sales and earn income, even if it was at a reduced level. Today, that's not the case. The takeaway is that the PPP, while extending the lifespan of a significant number of small businesses, is little more than life support. It remains to be seen how many small businesses will be capable of standing on their own once they reopen under uncertain economic conditions.

Coming off life support

For the small businesses who have found ways to stay afloat amidst the pandemic, they have to start making plans for how they're going to rebuild in the aftermath. How well those plans work will determine their ultimate fate. This is especially true in light of the uncertainty surrounding how fast consumer spending and business-to-business sales will pick up once businesses start to reopen en masse.

Here again, there are some lessons small business owners can draw from the experiences of those who shepherded firms through the 2008 recession. They make for a useful roadmap because the recovery from the doldrums of 2008 was slow going for most businesses, due in large part to depressed consumer spending that took almost eight years to recover to pre-recession levels. That means the strategies that worked then did so amidst economic conditions that were about as bad as they could get.

To help small business owners start planning for their recovery, here's a step-by-step overview of how to proceed, drawn in large part from what worked for the survivors of the 2008 recession.

1. Begin with a damage analysis

The first step in deciding how to proceed is to get an accurate accounting of how much damage the business has suffered as a result of the coronavirus crisis. The analysis of the situation has to extend beyond monetary losses, including losses of time and in-house expertise due to layoffs.

Begin with a thorough accounting of the business's financial condition, making sure that all bookkeeping is up to date and that all measures of financial health are current and available. Then go back through the business's financial history to compare the current performance with pre-crisis levels (results for January 2020 make a good base for comparison). The results should serve as a guide to what financial damage has occurred, as well as how far the business has to climb on the road to recovery.

The next thing to look at is the effects on the business that are harder to quantify. Consider what business projects were either abandoned or put on hold during the shutdowns and try to assign a monetary value to them (including lost revenue and overhead for the stalled projects, if applicable). Then, make a list of any employees whose specialized knowledge or skills may have been lost due to layoffs, and how those losses might impact the viability of those projects going forward.

Once complete, this analysis should represent a complete picture of the present health of the business, as well as offer some insight into what recovery steps will or won't be possible in the coming months. For example, if business projects depended on laid-off employees, their resumption will also depend on the business's ability to rehire or replace their expertise.

2. Reevaluate business plans

Since there's a high likelihood that certain aspects of pre-coronavirus business operations won't be able to resume in the near term, the next step is to look at the company's business plan to see what changes make sense. The best way to approach this is to revisit the process that yielded the original plan. That means redoing all of the market research and setting new targets for sales and overall growth that are in line with what might be possible under the present circumstances. It also means adjusting stated strategies to accommodate the reality the business is now operating in.

Tomas Gorny, CEO of Nextiva had this to say: “Do your best to continue to innovate and think big. And always keep the two most important things in mind: your customers and team. Take a cue from businesses that have successfully pivoted in both digital and tangible ways. Like Proof, a local artisan bread company that introduced new packaging, delivery, and additional pickup locations, plus a newsletter to help the community stay informed on where to find fresh food—locally.

Perhaps one of the best examples is King Arthur flour—rather than crumbling under a daunting demand for flour, they took great leaps to triple their monthly output of flour—and helped their team by transitioning cafe workers to new roles. Even bigger companies have done more, like pivoting from selling clothes to selling face masks, and from cosmetics to hand sanitizer. Most of these companies aren't implementing permanent solutions—they're thinking out of the box to support their community, their customers, and their business for the time being—and they're likely learning a lot for the future of their business, too.”

Removing a strategic dependence on in-person sales in favor of an increased digital presence is a likely component of this adjustment for most small businesses. The reason that this step is so critical is the fact that it's necessary to have it completed before seeking any additional funding sources to support the company's efforts to get back on its feet. Options like the SBA's loan and microloan programs, as well as most loan programs operated by private lenders, will all want to see an updated business plan as a part of their approval process. And considering that those decision makers will be dealing with a flood of small businesses all vying for a share of limited funding, the applicants with the most specific and realistic post-coronavirus business plans are certain to have the best chance of securing funding.

The Keap Advocate Referral Program is great way for customers, like you, who love💚 Keap to earn cash rewards for sharing the product with your network. Start getting paid here: https://t.co/KhTfT9xU3Z

— Keap (@KeapGrowing) June 16, 2020

3. Design a new marketing plan

The next thing small businesses should do on the path to rebuilding is to retool their marketing plans to reflect the post-coronavirus environment. What they shouldn't do, however, is look for ways to slash their marketing spend. There's plenty of anecdotal evidence that businesses should be going all-in on marketing as a defensive measure to preserve whatever revenue they still have, as well as to stay in a good position to rebound as the economy moves toward normalcy.

This is a bit of advice that served small businesses well in the wake of the Great Recession of 2008, with those that preserved their marketing budgets faring better than those who did not. It's fine, of course, to revisit strategies and look for ways to increase performance or eliminate marketing efforts that aren't working or necessary. In light of the current need to increase digital sales to offset in-person losses, one such change might be to reallocate funds from display advertising to bolster efforts at local digital marketing, such as reputation building via local reviews.

4. Establish a Recovery Timeline

After assessing the condition of the business and laying the groundwork to secure new funding and revitalize marketing efforts, the next thing to do is to create a timeline of steps to get the business back to pre-coronavirus operating capacity. The timeline should begin with securing the necessary funding as dictated by the revised business plan and necessary ongoing marketing spend, followed by a step-by-step plan for rehiring necessary staff. It should then move to the timing for restarting any stalled business projects as well as resuming customer-facing operations. Having all of the recovery steps planned in advance will provide a means of judging how well the business is executing the overall strategy. It will also make it possible to make adjustments to that strategy on-the-fly as conditions demand.

5. Secure funding

With the business ready to execute its recovery plan, the last step (and the most challenging one), is to secure the funding necessary to make it all work. Although it may seem like a daunting challenge, the good news is that small businesses have numerous funding options available to them if they know where to look. Depending on their total funding needs, as well as how long they expect it will take to repay the debt they take on, they can pursue options ranging from crowdfunding all the way up to private bank-issued loans and lines of credit.

It's at this stage where all of the preparatory work that went into the previous steps can make all of the difference. Having a realistic plan backed by up-to-date market research and a complete timeline for the process established will go a long way toward convincing lenders that they're not taking on too much risk. Right now, it's important to recognize that lenders, be they individuals or multinational banks, are all operating in the same uncertain environment as all of the small businesses asking for their help. That means they're going to be careful not to extend funding to any business that hasn't done its homework—and for those that prepare, they won't have to be concerned.

The road to recovery

With hard work and some luck, small businesses in the U.S. should stand a good chance of navigating the coronavirus economic crisis and coming out the other side in decent shape. The key to doing it, though, is to get to work right away on crafting a business-specific recovery plan following the steps outlined above and doing everything possible to execute it to the best of their ability.

As they do, they should bear in mind that although there's sure to be tough times ahead, they don't have to come to define their business. They should remember that the economic history of the U.S. is one of constant innovation and renewal, and that plenty of companies have thrived even in the worst of times. And for those who plan and work hard enough, there's no reason they can't join that ever-expanding list.

Before you go ...

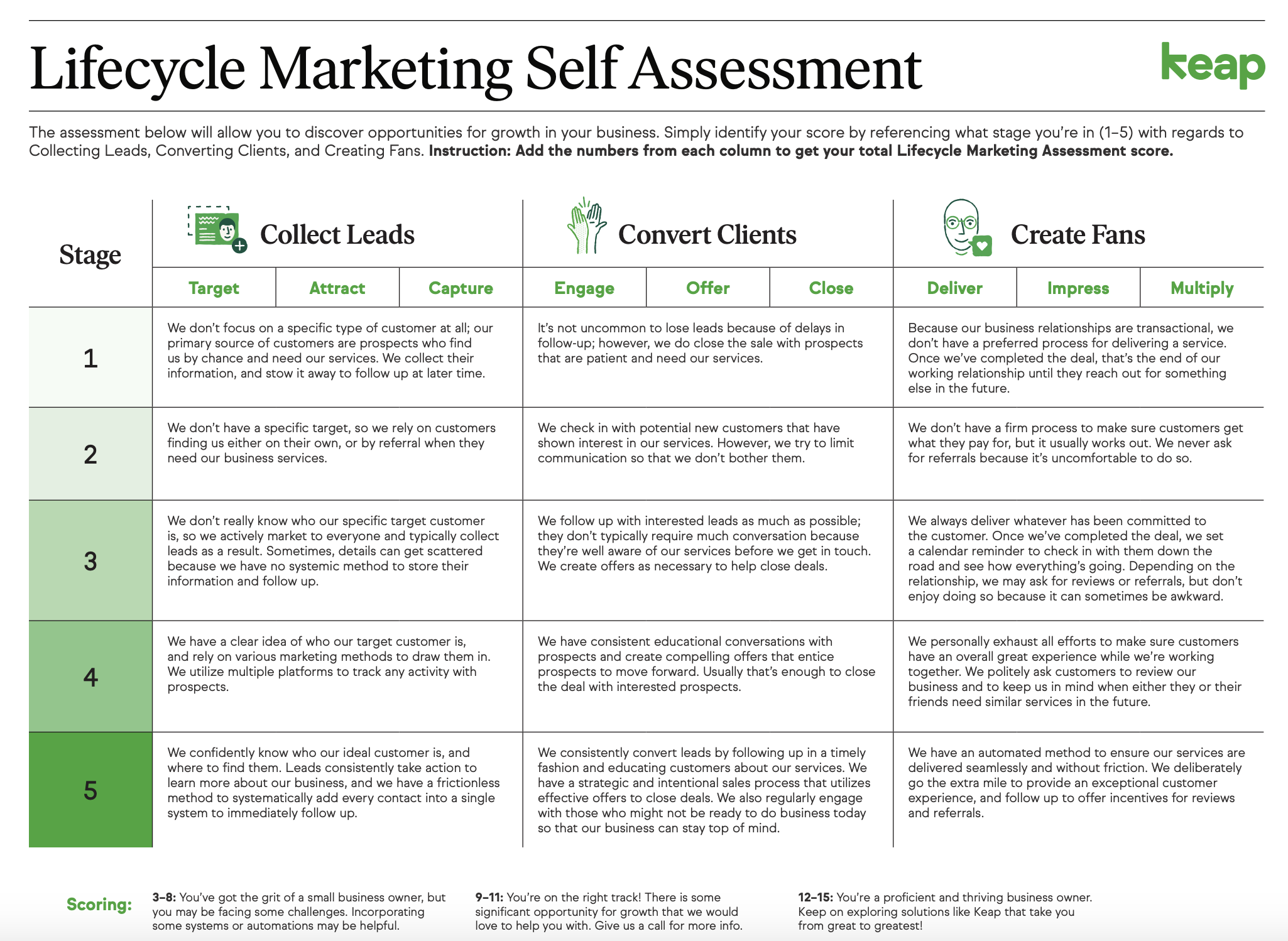

SEE HOW YOU RANK: Take Keap's Lifecycle Automation Self Assessment and compare your business against the industry’s top performers with our proven formula and instantly reveal the strengths and gaps of your business.