What are the 5 C's of credit?

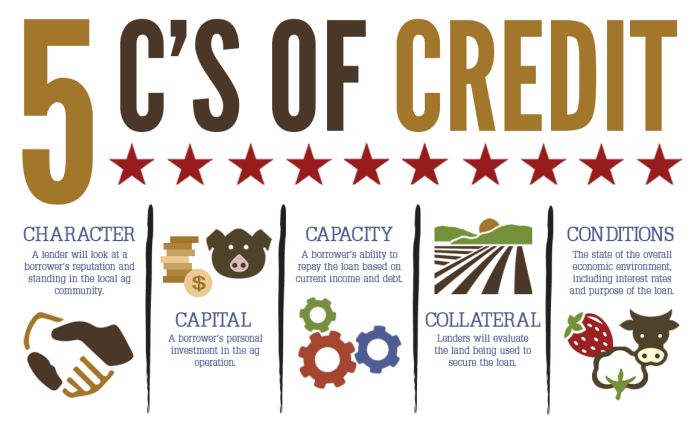

The five C's of credit are a common framework that lenders may use to evaluate the profile of a potential borrower, and include:

- Character

- Capacity

- Capital

- Collateral

- Conditions

As a small business owner, there will likely come a time when you need to apply for financing—which often means applying for a small business loan.

You probably know about credit checks, but what are the other factors a lender considers when assessing whether or not to take you on as a borrower?

In this article, you’ll learn business credit facts, how credit impacts your ability to get financing for your small business, and how good credit works in your favor.

The 5 C’s of credit

What are the 5 C’s of credit? This is the system lenders use to determine the creditworthiness of potential borrowers.

Source: AgAmerica

Here is a breakdown of each of the five C’s of credit:

1. Character

First up is character, and this includes the aforementioned credit check. Lending institutions will pull your credit report and credit score to assess your trustworthiness and reputation. Do you have a history of repaying other debts? Have you ever declared bankruptcy or had a lien against you? Lenders want to give money to those who have proven responsible in the past.

If you’re looking to get financing from a local or community bank, stop by and speak with the bankers. Building an in-person relationship can make them more likely to lend to you, as long as your credit report and score don’t raise any major red flags.

2. Capacity

Capacity is measured by looking at your company’s recurring debts in comparison to its income. Lenders will determine your debt to income ratio (DTI) to gauge the likelihood of your ability to pay back the loan. Companies with a low DTI are more likely to have the money on hand to make loan payments, and that in turn will make them a more desirable candidate for a loan.

3. Capital

Lenders will also look at the amount of capital a borrower is willing to put in when asking for a loan. The larger the contribution upfront from you, the more “skin in the game” you have as a borrower, making the lender feel secure in the fact that you’ll be less likely to default on payments.

If you’ve already invested your own capital in your business before turning to a lender for a term loan, equipment financing, or revolving credit, you’ll be a stronger applicant than if you were looking for the lender to carry a greater portion of the financial burden.

Check out Keap's Lifecycle Automation Assessment to determine where your business stands among the industry's top performers.

4. Collateral

If you don’t have “skin in the game” in the form of capital, lenders might look for you to use owned assets to pledge as security against a loan. Collateral serves as a backup if you’re unable to pay your loan for whatever reason, and it’s most common with equipment financing, car loans, or mortgages, where the item you’re purchasing with the financing becomes the collateral for the loan.

One of your first steps as a small-business owner should be to establish a proper business structure—like an S-Corp or LLC—before searching for financing, to ensure that your personal assets can’t be taken as collateral if you experience issues in repaying a business loan.

5. Conditions

Conditions of the loan—like interest rate, amount of principal, and how the lender intends to use the money—are all assessed by the lender when determining whether or not to work with a borrower. While those things are within your control, lenders will also look at external conditions—including macroeconomic issues and what’s going on in your specific industry—that could affect your small business’s income.

Of course, there’s not much you can do about the global economy, but you can be strategic about when you choose to apply for a loan. Perhaps counterintuitively, it’s best to apply for loans when your business is strong because lenders are more likely to take you on as a borrower when conditions are positive and repayment is likely.

Facts about getting a small business loan

Small business loans serve many purposes. From getting you out of a rut to helping you expand your services, they can take a weight off your shoulders when the stakes are high. They are, however, a big commitment—and if you’re not ready, they can end up as more hindrance than help. On top of that, they’re not always as easy to acquire as you may think. During difficult economic times, business credit scores can leave companies standing in the dust, waiting for a loan they’ll never be granted.

Follow these tips and you’ll be in a much better position to get the best deal—both for you and your business.

Keep all three credit bureaus updated

You need business credit for more than just a loan—it plays a part in winning new clients, too.

There are three main credit bureaus that collect your business data: Dun & Bradstreet, Equifax and Experian. Unlike personal credit, business credit information is available for everyone to see—employees, potential clients, and even your competitors.

Potential customers may check your information with sites like Dun & Bradstreet to determine if you’re a quality company to do business with. Any incomplete data or poor scores can affect whether you win their business. These vendors all produce data in slightly different ways, however. It makes sense to keep all of them updated since you don’t know which your lender will be using.

Use lenders that send feedback to these bureaus

Contrary to popular belief, small business loans don’t only reduce your business credit—they can also boost it. Focus on making your repayments on time to lenders who report back to these bureaus, and you’ll bolster your business credit.

This will make you eligible for larger loans at lower interest in the future. If you’re unsure whether your chosen lender reports back to these bureaus, ask them before moving forward.

Always repay on time, or early

All bureaus work out their scores based on [different debt service coverage ratio metrics], but almost all of them take your repayment history into account. If you’ve regularly made late repayments, the knock-on effect on your credit score will make it difficult to get a loan.

Certain bureaus, such as Dun & Bradstreet, only give perfect scores to those who repay early. Just ensure that your chosen lender doesn’t charge early repayment fees, as these can vastly increase the amount you have to pay back.

In summary

Being aware of the factors that lenders consider when determining who to work with is a key step in ensuring you’ll secure the financing you need to keep your small business running smoothly. Look beyond your credit score and consider the myriad other elements that may impact your approval for a small-business loan.